Back to: Starting your business

A lack of cash shouldn’t stop you starting your business.

Even if you don’t think you’ll need any financial support to get your business going, there will come a time in the life of the business that you will needs some additional funding. Indeed, the most common reason for a business to fail is a lack of ‘cash’.

Just because you need to borrow or raise some money doesn’t mean the business is in trouble and nearly all businesses have some form of debt agreement – if only an overdraft.

Just like all loans there are lots of firms and people who can lend you and your business money. The problem is that their appetite to lend it to you is based on their assessment of your business, its vision, role, and financial viability – in short, your ‘business plan’!

How to prepare yourself for finding money, or spending your own, is captured in your business planning – an essential requirement for business success and persuading people and banks to lend you money!

The place to start for help would be your ‘high-street’ bank but remember, they will look at you as a potential customer and not necessarily fully explain all the options available to you.

This section covers briefly the sources of funding you might consider and some government assisted agents who may be able to help your business through its, hopefully, long and profitable life.

Types of finance

There are essentially two types of finance to consider:

- Loans – which can be short term like an overdraft or over a longer term like hire-purchase or a commercial mortgage.

- Investment – This is the ‘Dragon’s Den’ style of raising money where people buy into your business.

Government supported funding

Investment financing for new businesses in supported by tax breaks by the government under two important schemes:

- SEIS – If your business qualifies, the Seed Enterprise Investment Scheme helps you raise up to £150,000 from investors who get significant tax benefits ( FY22/23 50% tax relief on the initial investment and, if held for 3 years, the investment is free of capital gains). Find out more about SEIS.

- EIS – Enterprise Investment Scheme allows a qualifying small business to raise up to £5m each year up to a maximum of £12m. Again, tax incentives are attractive to investors. Find out more about EIS.

The government also supports a ‘StartUp Loans’ network for new businesses who require up to £25,000 at a fixed interest of 6%.

If you are leaving the Services Family, our friends X-Forces are agents for the Start Up Loans package including support in your business planning during transition or after.

If you are leaving the Services Family, our friends X-Forces are agents for the Start Up Loans package including support in your business planning during transition or after.

If you are not a member of the Services Family, there are other sources like the Prince’s Trust who can be found through the British Business Bank.

Your funding requirement depends on what for and how long you need the additional financial support – that’s where your business plan helps!

Short-term financing

Business to business Credit:

Most goods and services provided to a small business are often on free credit and based on the payment period of the bill/invoice. Discounts are often offered to firms for early payment. The amount of inter-company credit depends on your purchasing power, your importance to the supplier and any special terms you can arrange.

Credit Cards:

The use of a credit card is an effective short-period loan. However, it is important to pay off the credit card fully or the credit interest is very expensive when compared with a bank loan.

Overdraft:

This is the most convenient short term and ‘small’ source but often the most expensive source for of credit when you take into account the fees and overdraft. Most banks offer a period of free banking for small business start-up but the use of the overdraft can trigger other charges as well leading to a rate as high as a credit card!

Factoring/invoice finance:

A complicated form of financing where your businesses’ unpaid invoices are used as security for a loan or sold on for say 80% of the face value. For example, a customer owes you £100 and has 30 days to pay but you need money now. You sell the invoice to someone for £80 cash now – they then get £100 in 30 days time.

Stocking loans and sales aid finance:

This form of support is available in specific businesses. An example would be selling goods where customers want to see or try a product – like a car sales business where a supplier may provide stock for the forecourt.

Medium-term finance

Leasing and hire-purchase:

Leasing and hire-purchase of assets needed to run your business is a form of credit which can apply to vehicles or tools.

Bank Loans:

The most common form of loan is the bank loan although this term applies to companies who provide credit which may not actually be banks but firm approved for credit operations by the Financial Conduct Authority. Start-up Loans UK is an example of a government supported loans finance company. These loans are offered at competitive fixed, variable or ‘floating’ rates and can be over short or medium term periods; typically, medium-term periods would be 5, 7 or 10 years.

Bridging Loans:

These loans are short to medium in term and used for a specific event; an office move or assets upgrade which will have a temporary impact on a business’s financial well-being.

Long-term financing

Commercial mortgages:

These are like home mortgages for business and the lender holds the asset(s) as security for the loan. Most high-street banks can provide these for certain assets.

Shares/equity:

Some start-ups require significant amounts of money to build their product or services. This money is raised by selling part of the business to third parties based on the current and/or future valuation of the business and applies only to businesses with a shareholder ownership structure. There are many sources of ‘capital investment’ from ‘Private Equity’ to pension funds. The investor expects higher returns the riskier the business model.

Where do most businesses get additional money from?

For small businesses equity finance often comes from:

- Private Equity or Venture Capital – Investors or funds that purchase segments of businesses in return for an equity share of the business.

- Periphery finance – Peer-to-peer finance, crowd funding, personal (including family and friends).

- Micro finance – Friends and family finance, saved personal finance, redundancy finance, some specialist lenders – often charitable/not-for profit organisations.

It really depends on how much additional money you need.

How much money will I need?

There are lots places you can get help and in the business planning course we get into the details of financial planning. But, just to get you thinking try this very simple start-up costs guide.

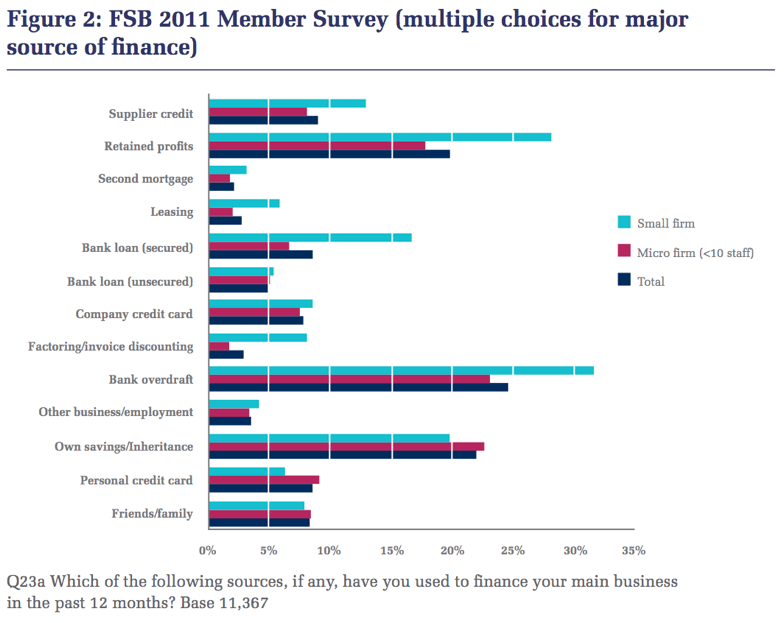

So, where do small businesses get additional funding?

IMPORTANT!

Credit Scoring

Credit scores are very important, as they will determine what a lender is prepared to offer you and at what rate of interest. It’s based on a number of factors, e.g:

- your employment history:

- how good you are at paying off loans and credit card bills etc;

- your phone contracts and other factors.

One thing to be aware of is that if you apply for credit and you are turned down, that could also go on your credit history as a negative – however there are numerous providers who offer tools to help you see your score and reduce the risk of rejection.

NB: Your score will go up and down over time and you can manage improvements before you look for credit– we have a section in our financial education modules which looks at this in more depth.